Approach

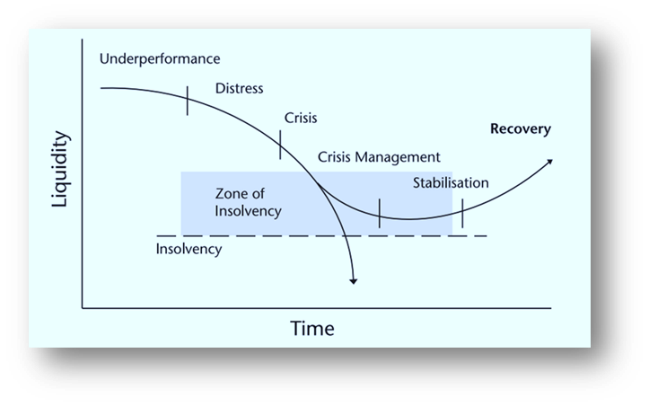

When a business is not performing as planned to know where you are on the Liquidity Chart is critical. Usually management thinks they are in a better position than actual. Understanding what to do a each point of criticality is vital. At HFCG a four step process is used.

2. Due Diligence

Our approach for commercial due diligence is to provide comprehensive deliverables that give our clients insight for actionable investment decisions—utilization of sound data-based analysis concerning target companies’ most pressing commercial and operational issues. Our approach accelerates the process, maximizes value and reduces buyers’ risks, thereby framing the acquisition for well-structured ownership and, eventually, an efficient exit. When does it make sense to use this process?

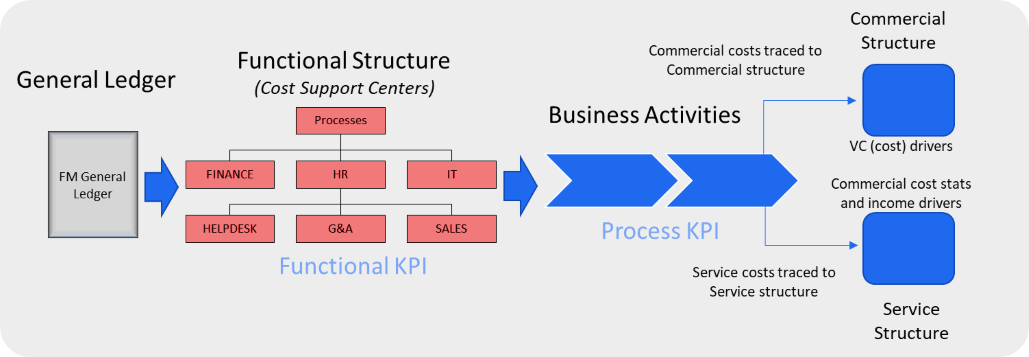

3. Value Chain Clean-up

A value chain is a set of activities that a firm operating in a specific industry performs to deliver a valuable product (i.e., sound and service) for the market. In his 1985 best-seller, Competitive Advantage: Creating and Sustaining Superior Performance, Michael Porter first described the concept.[1] There are many advantages of value chain analysis and clean-up by breaking product and service activities into smaller pieces to understand the associated costs and areas of differentiation fully.

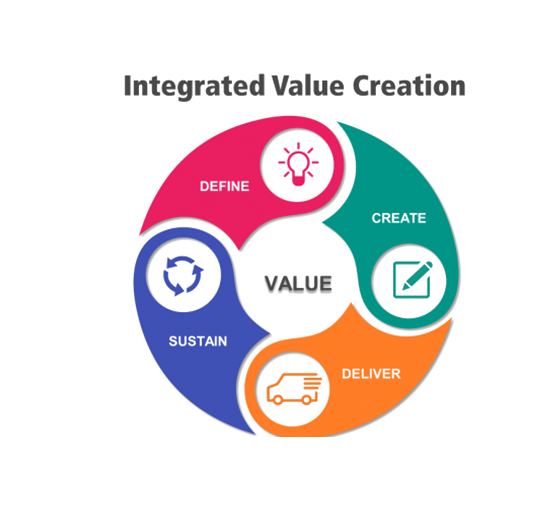

4. Value Creation

Value creation has long been stressed in the business literature as the main objective of organizations. Successful organizations must create value for its owners whereas others insist that value must be created not just for shareholders, but also for all stakeholders including employees, customers, suppliers and the community. How does Halloran Facilities Consulting Group integrate this into its Approach to helping clients Create Value?